Is Chinese business on the cusp of a ‘leapfrog moment’ in ESG reporting?

来源:World Economic Forum;发表于:2021-03-26;人气指数:495

Is Chinese business on the cusp of a ‘leapfrog moment’ in ESG reporting?

https://www.weforum.org/agenda/2021/03/chinese-business-leapfrog-moment-esg-reporting/

An employee working on a solar panel production line in Jiangsu province, China

Image: REUTERS/Stringer

25 Mar 2021

David Aikman

Chief Representative Officer, China; Member of the Executive Committee, World Economic Forum Beijing

Rebecca Ivey

Head of Impact, World Economic Forum

Kai Keller

Platform Curator, The Future of Financial Services in China, World Economic Forum

Kiera Han

Community Lead, Business Engagement, Greater China, World Economic Forum Beijing

*ESG reporting by Chinese businesses will be fundamental to achieving the country's climate goals.

*The Forum and PwC China brought together Chinese business leaders and ESG practitioners to explore the barriers and opportunities in ESG reporting.

*The findings are published in a new report. Here's a summary.

China’s ambition to reach peak carbon before 2030 and achieve carbon neutrality by 2060 will require Chinese companies to start transitioning to a lower-carbon business model today.Corporate reporting of a complete set of environmental, social and governance (ESG) metrics, including making emission data visible and comparable, will be a key ingredient to help regulators make timely policy decisions, guide capital flows, and enable customers to make informed decisions.

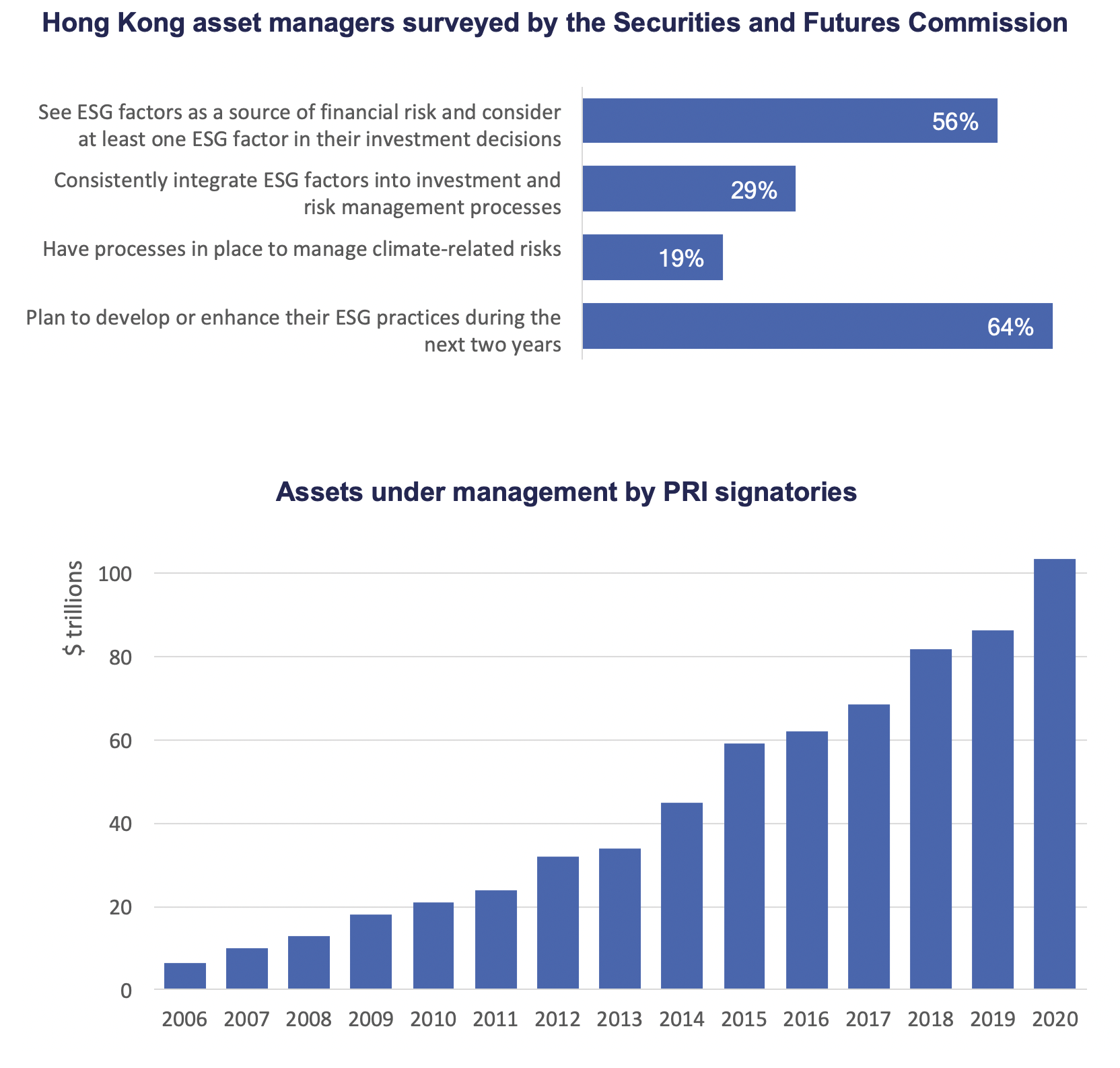

ESG reporting is now a global trend. Assets under management (AUM) by signatories to the United Nations Principles for Responsible Investment (PRI) surpassed $100 trillion in 2020, an increase of 75% on 2015. In China, ESG queries from investors have increased noticeably in the past two years. But how quickly is the transition to ESG measurement and reporting occurring in Chinese companies, and what are the barriers and opportunities to embed ESG strategies and solutions in the mainstream of Chinese business practices?

To answer these questions, the World Economic Forum brought together Chinese business leaders, senior executives and ESG practitioners over the past nine months to explore the state of ESG reporting in China and map the key opportunities and challenges for Chinese companies and investors moving forward. Together with our knowledge partner PwC China, the findings have been published in a recent white paper entitled A Leapfrog Moment for China in ESG Reporting.

Trends

in ESG reporting in China

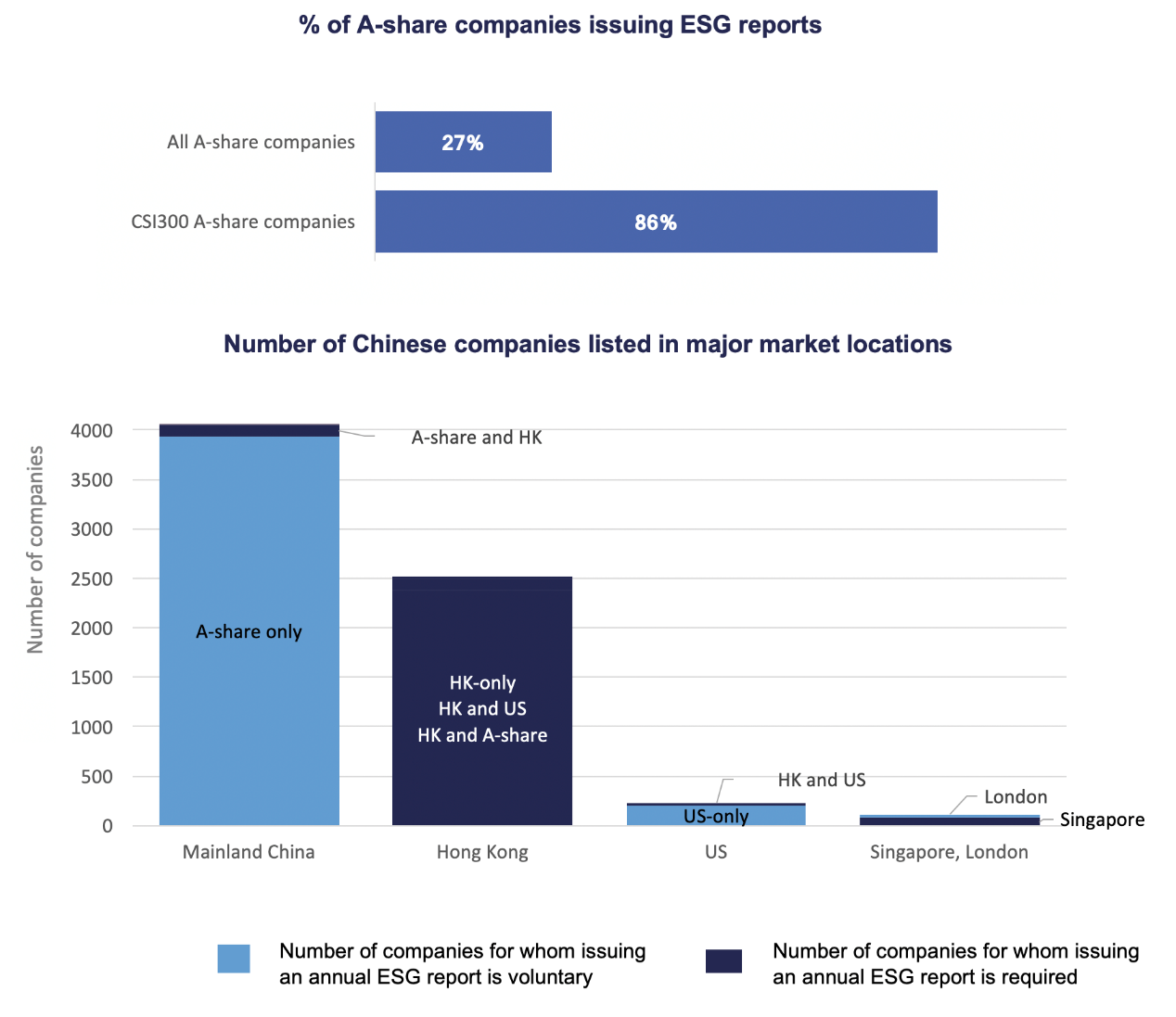

The good news is that there is

a positive trend of voluntary ESG reporting in China. As of mid-2020, 1,021

Chinese A-share companies (that is, companies listed in RMB on the Shanghai and

Shenzhen exchanges) had published annual ESG reports (including those labelled

as “sustainability”, “CSR”, etc), up from 371 companies in 2009. Of these,

about 130 A-share companies have dual listings in Hong Kong, where ESG reports

are required (see figure below).

Image: SynTao Green Finance; Bloomberg, PwC analysis

The largest Chinese A-share

companies are more likely to issue ESG reports: 86% of the CSI300 companies

(the 300 largest and most liquid A-share stocks) had published reports as of

mid-2020, nearly matching the 90% rate among S&P 500 companies.

Domestic regulators are also

helping to drive the momentum for corporate ESG reporting in China. Hong Kong’s

stock exchange (HKEX) has required listed companies to issue ESG reports since

2016, and disclosure requirements were upgraded in July 2020. Market

participants expect that regulators will issue new ESG reporting requirements

for companies listed in Shanghai and Shenzhen.

Hong Kong’s regulators recently

announced that climate-related disclosures aligned with the TCFD

recommendations will be mandatory for financial institutions and all relevant

sectors, including asset managers and insurers, by 2025. In February 2021, the

China Securities Regulatory Commission (CSRC) issued a market consultation that

proposed a revision to investor relations guidelines. It added ESG information

to a list of issues on which listed companies should update investors.

Insights

from Chinese companies

However, Chinese companies and

industry sectors are spread across a range of ESG performance. According to

MSCI, which rates the ESG performance of around 700 Chinese companies, more

than 50% of companies still rate in the bottom-two categories on a seven-tier

scale, but the number of companies rated in the upper-five categories increased

from 191 to 327 companies in just two years between 2018 to 2020 (see figure

below).

Image: MSCI / PwC analysis

What are successful Chinese

companies doing today to put them ahead of their peers and competitors, and

what can other companies do to catch up? Here are three key insights that

emerged from a series of discussions and interviews:

1.Board-level commitment is a

primary and indispensable key to Chinese companies’ effective reporting and

management of ESG issues. The integration of ESG factors into business strategy

formulation and the management of ESG risks and opportunities provide more

meaningful information for investors than the traditional corporate social

responsibility (CSR) approach.

2.High-growth companies must

graduate from a focus on near-term revenue to a purpose-driven strategy that

considers a wide range of stakeholders and their interests. Successful

companies focus their ESG efforts on the issues that are most relevant to their

business, as identified in their 'materiality assessment'.

3.As Chinese companies ramp up

their ESG reporting, they often find a shortage of ESG professionals and a lack

of ESG knowledge across their business units and supply chains. More training,

peer-to-peer sharing and continued consolidation of the disclosure requirements

and data will be needed to make ESG reporting mainstream in China.

Image: Securities and Futures Commission of Hong Kong;

PRI analysis

A

call to action for Chinese businesses

Chinese companies are approaching a leapfrog moment in ESG measurement and reporting. Leapfrog opportunities arise when a developing or emerging economy has the opportunity to utilize new technologies or innovative practices to bypass slower stages of development.

Chinese companies are seeking

to emerge from the COVID-19 economic crisis and attract domestic and global

capital investment at a moment when there is a global convergence of views that

companies must move beyond generic statements of corporate responsibility and

toward concrete, comparable and financially relevant ESG reporting in order to

secure easy access to financing and maintain their public and social license to

operate.

Strong ESG practices can pave

the way for more resilient businesses, open up entirely new markets for

sustainable products and services, and help Chinese companies attract new

sources of capital. We hope this paper can strengthen the call to action for

business leaders across China to further enhance their ESG reporting

capabilities and communicate their holistic performance more effectively to

domestic and global stakeholders.